What Are the Reasons to Say No to Credit?

Aug 31, 2022 By Triston Martin

Introduction

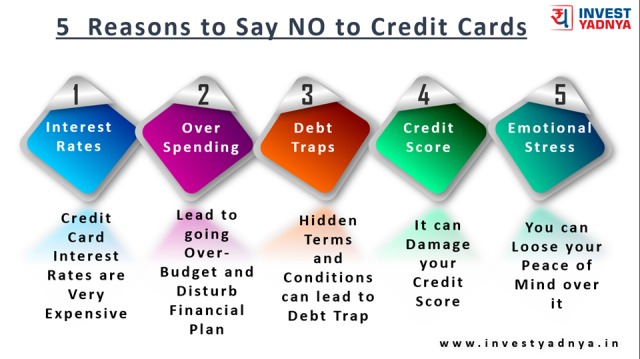

One's credit card is often seen as a lifeline in times of trouble. Sometimes, they even prove to be one. But the million-dollar question is whether or not this justification warrants credit card ownership. There are many other benefits to using credit cards, such as making purchases with no interest for 45 to 55 days and establishing or improving credit history. Good! But have you ever considered that credit cards could help you make your credit record and score, but they can also destroy them permanently if used irresponsibly? If so, you'll never be able to take out a personal or home loan in your life.

Do you know that millions worldwide have lost their homes due to credit card debt? Why? Since the premise of credit cards is "Spend Now, Pay Later," the vast majority of cardholders will spend beyond their means, sometimes to impress others and other times to keep up an artificially inflated "social status." And then it's too late for them to realize their mistake! In this article we will discuss the reasons to say no to credit.

Self-Control is Discouraged by Credit

A lack of fiscal discipline can, at best, leave you without the safety net of a stable income. At worst, a habit of making hasty purchases can damage your sense of self-worth, your ability to control your substance use, and your relationships with others. Self-control is difficult and boring, but it has many rewards, including achieving financial goals like home ownership.

You Probably Don't Have a Budget

It's easy to lose sight of the fact that little things like buying a cup of coffee here and a new book there can add up to a significant amount over a month if you don't keep track of your spending. Many people find great success in using budgets to control their spending. It's easier than you might think to make one if you don't already have one. An easy budget could be as straightforward as keeping track of your monthly income and expenditures and adding up the sum. You will have a maximum spending limit depending on how much money is still in your account.

Interest Costs A Lot

Regarding financial matters, it is essential to exercise restraint for reasons that have nothing to do with ethics or spirituality but are rather more pragmatic. Your expenditures will cost more than expected because of credit card interest.

Rates May Increase If Balances Are Unpaid

Worse, it's possible that the low introductory APR on your credit card is only temporary and will increase if you don't pay the balance in full. Thus, an APR of 8% could shoot up to 29% in the blink of an eye if this were to happen.

A Low Credit Score Has a Big Impact

An unexpected increase in your insurance premium may occur if you have an outstanding credit card balance. Suppose your credit score is used to set your insurance premiums. In that case, the insurance company may assume you are more likely to make late payments because you are negligent with other aspects of your financial life, such as vehicle and home maintenance. Having poor credit may cause further problems. If your credit score is too low, you might not get hired by the companies that examine applicants' credit reports.

Poor Habits Put Your Relationships at Risk

According to research, money is the leading cause of conflict in families and relationships; it may be especially touchy when resources are scarce. Therefore, couples and families must practise fiscal discipline and create a family budget whenever possible.

Finance Increases Spending

Many people waste more money on frivolous or overpriced purchases when they use credit cards instead of cash—for psychological reasons, purchasing a $1,000 laptop or smartphone will seem less life-altering if all that is required of you is to sign a receipt and forget about making a monthly payment. Instead, when you pay with cash, you'll get a tangible sense of the value of the items you're purchasing and the amount of money left in your wallet. If you pay with a check and keep track of it in a cheque book that shows the impact on your account balance, this may also be true, though to a lesser extent.

Conclusion

The best way to use credit is to pay your bill in full each month, but mismanagement of credit cards can have fatal results. Credit cards are useful financial instruments because of their convenience, security, and rewards programmes. However, weighing the benefits against the hazards is important before getting into debt.

-

![]() Mortgages

MortgagesHow to get out of debt with credit cards

Susan Kelly Oct 29, 2022

-

![]() Investment

InvestmentHow to Buy Stocks Online

Triston Martin Apr 05, 2023

-

![]() Mortgages

MortgagesAll You Need To Know About Sezzle In 2022

Susan Kelly Sep 11, 2022

-

![]() Taxes

TaxesTax Paying System for Overseas

Triston Martin Sep 07, 2022

-

![]() Taxes

TaxesWhat you should Think About Circuit Breaker Programs for Property Taxes

Triston Martin Oct 29, 2022

-

![]() Banking

BankingWhat Are the Reasons to Say No to Credit?

Triston Martin Aug 31, 2022

-

![]() Mortgages

MortgagesStudent loan tips for international students

Susan Kelly Mar 10, 2023

-

![]() Banking

BankingOverview Of OpenSky Secured Visa 2022

Triston Martin Oct 11, 2022