How to get out of debt with credit cards

Oct 29, 2022 By Susan Kelly

You'll need to make some sensible financial decisions to get out of debt and decrease your credit card interest rate. Debt snowball and debt avalanche are the two most popular personal finance strategies for eliminating card debt. Which of them will inspire you more to keep going? That's the deciding factor. The debt snowball and the debt avalanche are designed to help you feel better, but the debt avalanche emphasizes the statistics. There are benefits and drawbacks to each strategy, but first, let's talk about why paying the bare minimum payment on a credit card will forever make you mired in debt.

Utilizing An Avalanche Technique

Prioritize your loans based on their interest rates if you want to pay them off faster. Make the minimum payments across these, but put any extra funds toward the commitment with the greatest interest rate. This strategy is sometimes called the "avalanche" approach of paying off debt. According to J. Dennis Mancias, a former financial adviser with Symmetry Planning Solutions throughout San Antonio, this method is ideal for savings since, in the end, you will have paid little interest compared to other strategies. Say you had $600 available toward debt repayment each month; usually, you would prioritize paying off the loan with the most effective interest rate. Once you've paid off your highest-interest loan, you'll have more money to pay off your following highest-interest obligation.

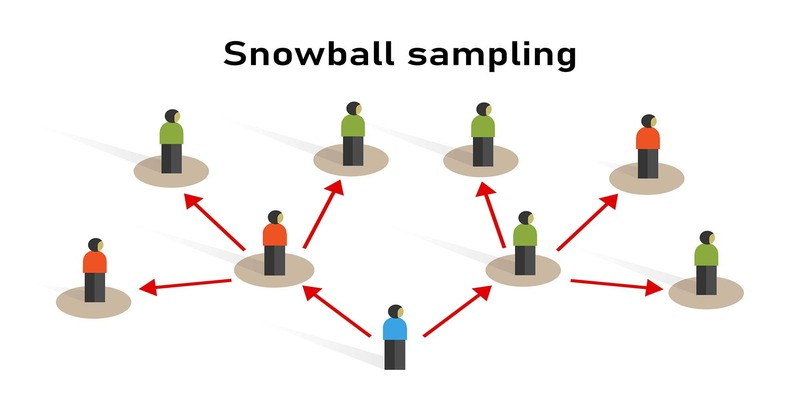

Use Of The Snowball Technique

By starting with the lowest debt and working your way up to the greatest, the "snowball approach" helps you get out from under your financial burdens. Debt paid off as quickly as feasible might serve as a powerful incentive to keep you on track. Following the same pattern as the "avalanche" approach, you pay the bare minimum on all your debts until you reach the one you've chosen to prioritize. After the debt is paid off, the funds initially earmarked for it are moved to the following most outstanding obligation.

Think About Getting A New Credit Card And Transferring Your Debt To It

Assuming you make your minimum payments monthly and keep your credit usage ratio low, you may be eligible for a stored value card with a 0% APR promotion despite your debt load. You may transfer your high-interest balances towards the new card with a 0% APR promotion that lasts for 12-21 months. Because of the money, you'll save on interest payments during the introductory 0% APR term. Paying off your high-interest debt will be far less complicated and take much less time. According to Navy Credit Union's Associate Vice President of Financial Services, Justin Zeidman, "you should constantly pay attention towards the interest rate when the promotional time is finished."

Reduce Your Outlays For The Time Being

Unexpected medical and emergency costs are common causes of credit card debt. Overspending is a common contributor to debt, as is the inability to control one's spending habits and avoid spending more money than one earns or has in their account. Making a fair budget is the best step in decreasing your debt because it provides complete insight into how much money is being spent.

Conclusion

Credit cards provide a convenient method to bridge the gap between what you owe and what your income can cover right now. However, the interest accrued on credit card debt may quickly snowball into a substantial additional price. Several options exist to help you manage your credit card debt and get your finances back in order when the time comes to pay it off. The most recent figures from the New York Fed put American credit card debt at $841 billion. And yes, you did read it correctly: a billion. Per Americans, the typical credit card debt is $5,221, according to Experian. Ouch. Therefore, you are not alone if you are carrying a load from month to month and finding yourself unable to make the minimum payment while still paying all of your other payments on time.

-

![]() Taxes

TaxesWhat Is A Tax Schedule? A Detailed Guide

Triston Martin Sep 29, 2022

-

![]() Banking

BankingUSAA Rewards American Express Card Review: Pros and Cons

Triston Martin Aug 22, 2022

-

![]() Investment

InvestmentKeep part of the profits as the backup cash

Edward Weston Apr 17, 2021

-

![]() Mortgages

MortgagesAll About the Types of Home Inspections Buyers Should Know

Susan Kelly Dec 26, 2022

-

![]() Mortgages

MortgagesStudent loan tips for international students

Susan Kelly Mar 10, 2023

-

![]() Mortgages

MortgagesTop Reverse Mortgage Companies

Susan Kelly Aug 30, 2022

-

![]() Banking

BankingIn What Ways Is a Credit Score of 760 Useful?

Triston Martin Jan 15, 2023

-

![]() Mortgages

MortgagesThe Finest PHFA Mortgage Lenders

Susan Kelly Mar 05, 2023