All You Need To Know About Sezzle In 2022

Sep 11, 2022 By Susan Kelly

Introduction

There has been a considerable uptick in the popularity of BNPL among internet buyers. Sensor Tower Store Intelligence reports that the number of people using BNPL services every month increased by 186% between September 2020 and September 2019. Sezzle entered the BNPL market in the same year it was established in 2016 and has since grown to become a competitive player in the sector. Most of the company's transactions take place online, but in September of 2020, it introduced a virtual card called Sezzle that can be linked to mobile wallets like Apple Pay and Google Pay for usage in stores. If the concept of BNPL services has piqued your interest, read on for some details on Sezzle.

How Does Sezzle Work?

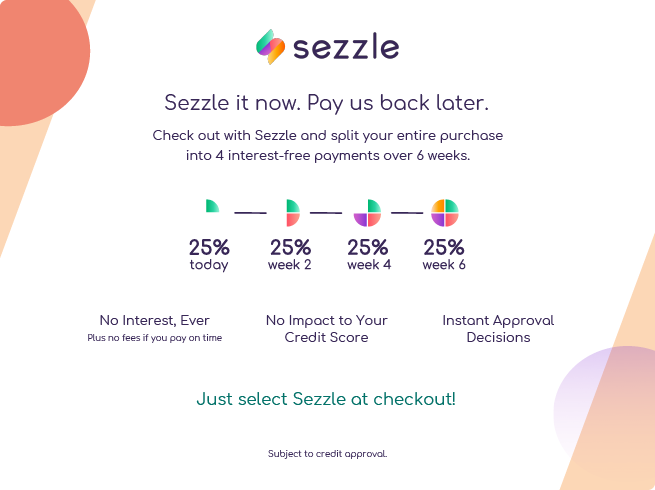

With Sezzle, you may make a purchase and schedule a later payment at no extra cost. When you purchase with Sezzle, our one-of-a-kind approvals system analyses your finances to determine which payment option is best for you. You'll be offered a two-payment plan by default. Half of the order total is required immediately, with the other half due 30 days later. If you want to pay for your order in four instalments over 30 days, the first instalment (commonly known as the "downpayment") will be due 30 days after the order is placed, and the next three instalments will be due 15, 30, and 60 days after that. New Pay in 4 options will become accessible as you spend more money. There will be no charges or interest of any kind. There are no charges, provided that payments are made on time.

Getting Started

If you want to shop on Sezzle, you need to meet a few requirements, the first being that you're at least 18 years old. Get a text-enabled phone number in the US or Canada. Has your email address been confirmed? Be prepared to pay with a method that is not prepaid; in the United States and Canada, this would be a debit or credit card. You won't get a bad credit report for using sizzle. To assess your financial flexibility, we may perform a soft credit check ("soft inquiry"), which will not have an adverse effect on your credit rating. Please note that bank accounts cannot be used to sign up for or complete purchases on Sezzle; however, they can be saved as a preferred means of payment for recurring bills.

Is There A Maximum Purchase Size When Using Sezzle?

Sezzle limits customers' purchasing power. You may be eligible for a higher limit based on your length of service, previous purchases, current credit, and other variables used to determine your limit.

How To Use Sezzle For Your Business

To accept Sezzle payments from your customers, you must first obtain clearance from Sezzle. A few standard questions about yourself and your company will be among those you'll be asked to answer during the application process at Sezzle. If you want to succeed, you need to have the following on hand: The length of time that you've been operating as a company. A forecast of your company's total annual revenue. Business taxpayer identification number and social security number. Some Other Forms of Business Documentation Sezzle's average turnaround time for letting you know if you're accepted, and your transaction rate is three business days. Your business's creditworthiness, annual sales, and operation length are all factors determining your interest rate. It usually takes 5-10 business days for the money to show up in your account after a shopper purchases.

Do Products Bought With Sezzle Ship After The First Payment?

Sezzle, like the rest of BNPL's offerings, is a step up from traditional layaway plans. Sezzle allows you to make the purchase immediately and then make the first payment when you've received the goods. You owe the remaining payment to Sezzle, not the retail store because Sezzle pays the merchant for your transaction.

Benefits Of Using Sezzle

If you can't acquire a sound credit card or loan elsewhere but need money quickly, Sezzle is an excellent option. This is a more flexible way to receive payment plans for goods without using or having a credit card. Want to improve your credit score? Sezzle does not share your financial activity with financial institutions. However, an upgrade called "Sezzle Up" relays economic activity to TransUnion. With on-time payments, one can establish a solid credit history.

Conclusion:

Acceptance into Sezzle is contingent upon satisfying their standards, including a minimum credit score. After a company has been approved, they must install Sezzle on their website or retail location. A comprehensive checklist and procedure brochure will assist with the setup process. You'll need to integrate a widget into your e-commerce platform if you run an online store.

-

![]() Mortgages

MortgagesStudent loan tips for international students

Susan Kelly Mar 10, 2023

-

![]() Mortgages

MortgagesTop Reverse Mortgage Companies

Susan Kelly Aug 30, 2022

-

![]() Taxes

TaxesTax Filing Advice for Married People

Triston Martin Sep 13, 2022

-

![]() Banking

BankingUse Either PayPal Or A Credit Card

Triston Martin Sep 21, 2022

-

![]() Investment

InvestmentTop 3 Index Funds For Investors With A Long-Term Perspective

Triston Martin Oct 28, 2022

-

![]() Mortgages

MortgagesHow Treasury Notes Impact Mortgage Rates: What You Need To Know

Susan Kelly Sep 22, 2022

-

![]() Taxes

TaxesWhat Is A Tax Schedule? A Detailed Guide

Triston Martin Sep 29, 2022

-

![]() Mortgages

MortgagesAll About the Types of Home Inspections Buyers Should Know

Susan Kelly Dec 26, 2022